16th of May

is the D Day. The elections results for 2014 general elections are going to be

out. This will pave way of the next government.

The entire nation

and specially the markets will keenly follow the election results. We all very

well remember what the market reaction last time results were declared was.

Most exit polls

have sung to the common tune of ab ki bar modi sarkar this time. The exit polls

have signaled a positive outing for the NDA . The projections from channels

vary from 250 odd to about 340. What is important to watch out is will NDA be

able to achieve the magic figure of 272 or get to a close distance of it. On the other hand we also know that exit

polls can go way off the mark too ( last general elections exit polls most

agencies got it way to wrong).

So expecting a volatile

movement in the markets, we all know at least that the market may not stay at

the same levels after elections. How to maximize the gains with a minimum

calculated risk potential?

Apart from our

advanced trading systems & advisory Powertrade have always endeavored to think

out of the box an provide innovative investing & trading ideas (Our long

time readers will recall our strategy of covered investing ,when we advised

investors to go long in NIFTY ETF 6200 levels then http://powertrades.blogspot.in/2013/11/investment-or-trading-in-markets-at.html)

So lets have a plan

to gain in the markets this elections.

Based on the exit

polls we want to go Long in NIFTY, yet don’t want to loose if markets crack

right?

First an analysis

of NIFTY Levels

Nifty Has

resistance at 7200 and a long term break out can be achieved above 7500 , where

markets can even hit 7900-8000 zones in next sessions if that level is cleared

Similarly Nifty has

critical support at 6900 levels and a any indication that NDA may fall short of

the magic levels will mean a blood bath in the markets.

So here is our magic

strategy to trade based on those two levels (7500 on upside & 6900 on

downside)

|

Type

|

Strike

|

Quantity

|

|

NIFTY CE Long

|

7200 CE

|

100

|

|

NIFTY CE Short

|

6900 CE

|

50

|

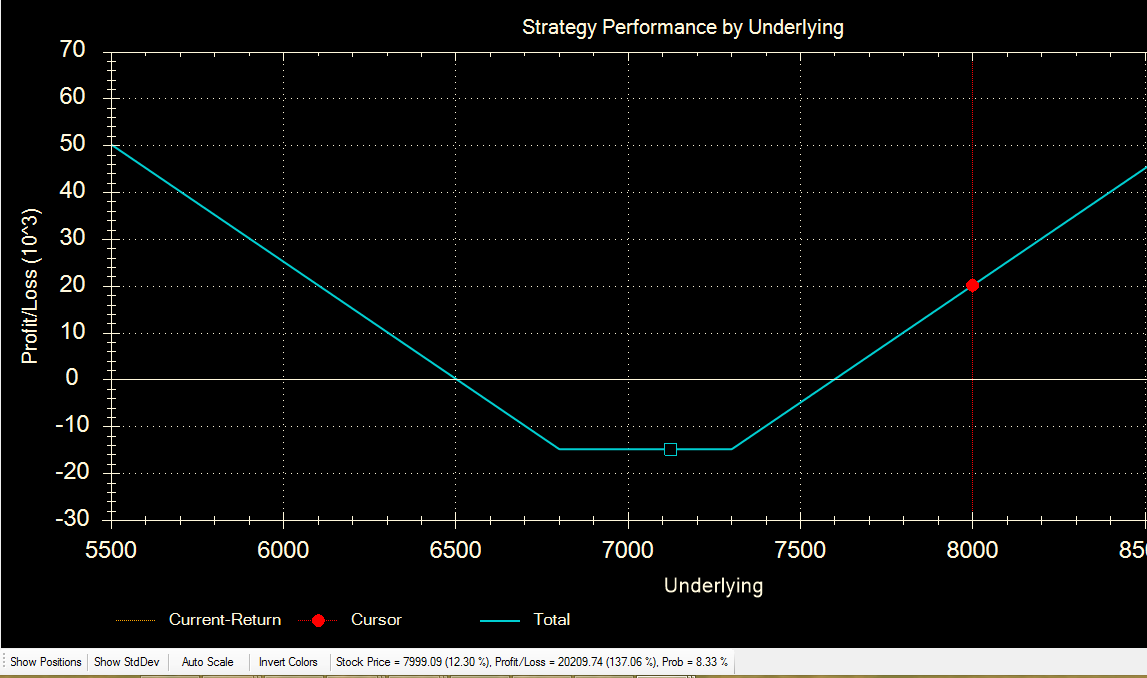

Strategy Risk

Reward:

·

Gain if

NIFTY reaches 8000: 23,566 INR Per Lot

·

Loss below

6900 (any level): -1640 INR Per Lot

This strategy is

based on the premise that markets will react either way and will not stay at

these levels and we want to be sure that we don’t lose if it falls

Alternate Long Only Strategy:

This is an

alternate strategy for players who want to earn on either side by and are expecting a big move in line with

what happened after last elections. This strategy is also a long only strategy

|

Type

|

Strike

|

Quantity

|

|

NIFTY CE Long

|

7200 CE

|

50

|

|

NIFTY PE Long

|

6800 CE

|

50

|

Strategy Risk

Reward:

·

Gain if

NIFTY reaches 8000: 20,461 INR Per Lot

·

Gain if

NIFTY Reaches 6300: 10,135 INR Per Lot

No comments:

Post a Comment