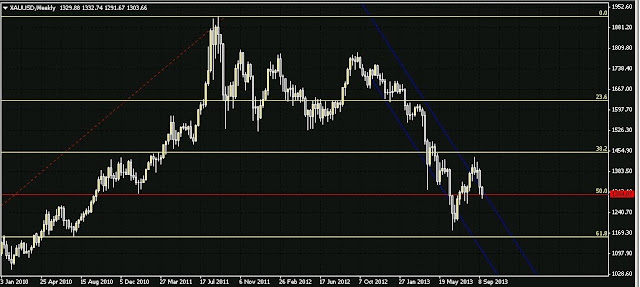

Here is a quick update on

what on the trading charts that we have discussed two days back. It was spot on

swing trade with respect to that level. Let us discuss what is in store for the

upcoming sessions.

The other day we posted

that Nifty Future has resistance around 5960 levels. We mentioned that all

pullbacks to that level will be shorted. Nifty on 24th September made a high

of 5962. We also mentioned that Downside target emerges at 5810-40 zones.

Market today found support at 5820 and retraced back from there.

Our swing traders were

short at the break of the 5960 levels and exited at 5840 just in line with the

trading levels posted.

Immediate hurdle lies now

at 5905 levels and trading above that markets will try to retrace back to the

trading levels of 5960 on the upside. On the downside it will be better to try

pull back trades on dips with stops at 5810 levels.

Fresh short trades will

again be active in case Nifty future manages to close below 5800 trading

levels.

Here is also an analysis and

review of what the options data are suggesting since we are nearing expiry

options accumulation along with price point analysis provide good levels for

low risk pull back opportunity and some fantastic break out opportunities.

Here is a look at the

options chart:

|

| NIFTY OPTIONS ACCUMULATION- 25 SEP-2013 |

Nifty has terrific

accumulation at 6000 zones. This suggests

that it is the toughest resistance zones. Hence swing traders can look to short

on pull back to that trading levels. Similarly support lies at 5700 and 5800

trading levels and this will offer support zones to the market on the downside.

A breach of 5800 can trigger a slide to test 5700 levels in a short time.