Trading is a tough

activity, the key is not only to enter the trades at the right time but to

trial the trades in a systematic manner to gain big in good trades. For this a

traders needs to be guided through in a systematic manner, especially he is

doing trading part time or tracking multiple scripts. One cannot manually

handle all and yet efficiently leverage all opportunities

Our guided trading systems

provide as a perfect ally to a trader to help him through the enter trading

process, as to when to initiate a trade, how to trail it and when to book

profits. These systems can be both run manually and also be fully automated

with complete hands free trading. If we are using automated tools and solutions

in all other sectors, why not when it comes to trading , where efficiency and

execution ease can lead to dramatic improvements in returns.

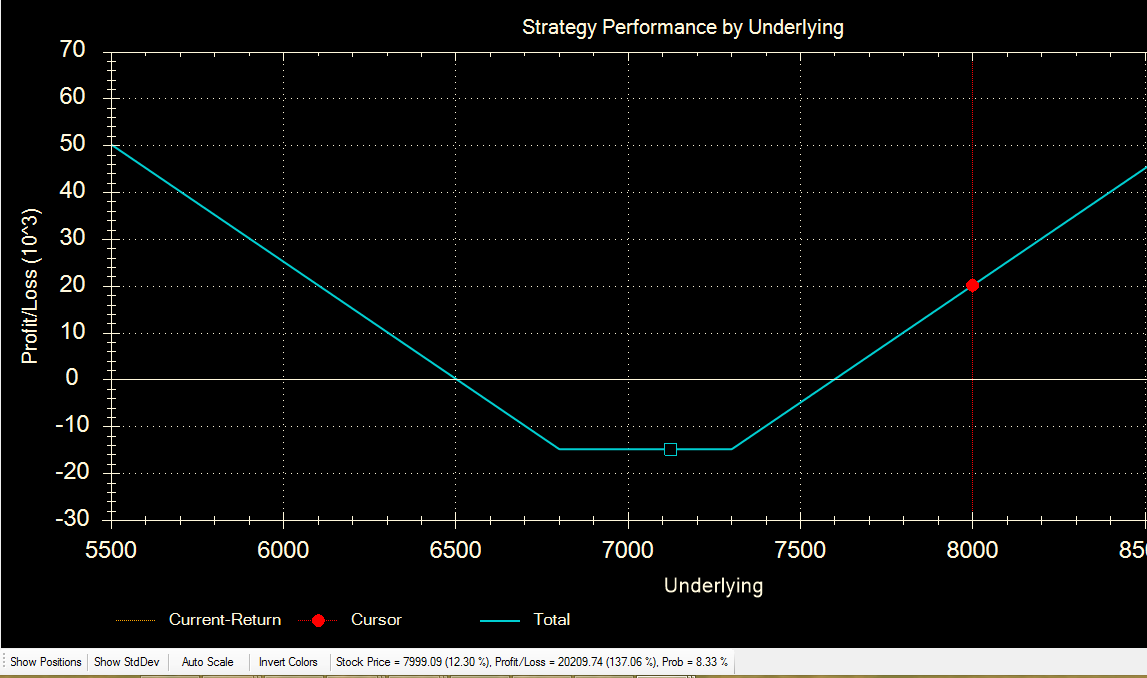

By the way sample this one

trade recently when JPASSOCIAT; cracked big time. Many would have entered the trades in a timely

manner, but only our guided traders managed to hold it through to maximize the

gains, as the system kept on trailing in a smart manner. Many would have lost

trying to go contrarian and all as well. Pictures speak best and here it is

below. This one trade gave 40X ( over 1 lac INR/Lot) returns

the cost of the system…. Yes roughly 3.5 years of subscription cost earned in a

single trade… Make trading predictable

with investment in advanced trading solutions & systematic trading.

|

| JPASSOCIAT Futures Trade |