US polls Starts on November 08 and results are expected to come

out by November 9th in the next 24 hours.

The race for the 45th president of United States has

picked up some pace and has become much closer than that anticipated.

The race is between Hillary Clinton (Democrat) and Donald Trump (Republican).

US elections are a two party system. The

markets in large favors the Democrat, partly for two reasons. 1. It kind of

maintains a status quo with respect to policies of the democrat already pursued

by Obama and 2. Mainly because Trump’s views are perceived as nationalist right

wing and hence he favors trade and employment protection, which markets and

businesses hate in general.

This is an event which is neither in our control or hands to

predict or make work, however one might say. The thing is that there are only

two possibilities so by random behavior 50% of predictions will be correct.

Lot of traders fail in the business of trading is because they

perceive to believe that markets will work their way, while it is way beyond

their control. Do we know the outcome- No, Can we trade the Outcome- Probably Yes. But the smart bet will be to trade it with a plan where the risk is capped, or the potential to earn on a move on either side.

Knowing to manage your risks and protect your capital is more than half the job done.

This is where

systematic trading / mechanical trading gives in the discipline to follow a strategy

over and over again rather than being speculative.

The race recently picked up some steam because of possibilities

of black votes swinging in favor of republicans and the alleged accusations

into the email controversy. At the time of writing this, FBI has given Clinton a

clean chit.

The Results will mostly

by out by November 9th, 2016 9:30 AM IST

.How are markets

expected to react?

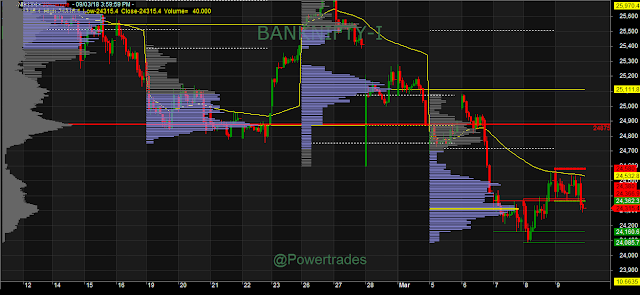

Expect a volatile November series for the rest of the month, hence

there can be possibilities of short bursts of directional trades. Advice would

be to trade a time frame lower in this case to lock in gains. Especially until

volatility subsides. This means if you normally trade daily charts, adjust and

trade hourly charts.

My own hunch is that that even after that till the Christmas breaks

market will remain a volatile traders market.

From a technical point of view until the base of 8450-8500 holds

we will expect an upside. In case Clinton wins, which is a still better

probability we can see a bit of euphoria for some time

To trade the markets, I advise that traders use our ProQuants

Hedged strategies and manage the risks while ensuring good returns too.